In September 2021, a large number of Indian marketers experienced a setback due to the RBI’s e-mandate, which paused their conversion-driving campaigns and caused them to set up multiple accounts in an effort to reactivate the campaigns.

Facebook’s billing experience continued to be affected for a few weeks as more banks and payment partners become compliant with the mandate.

This blog is meant to give insight into billing and payment for those marketers already using or considering using Facebook Ads in order to keep their campaigns running without any interruption.

‘Billing & Payments 101 – Facebook Ads’ guide will uncover

How Facebook Ads fees are calculated?

What is the best payment method for Facebook, automatic or manual?

What is the new RBI e-mandate for Facebook advertisers?

How Facebook Ads fees are calculated?

The amount of money Facebook Ads charge is determined by:

- How often the adverts are seen by people

- How many people click on the ads

What is the best payment method for Facebook, automatic or manual?

Some advertisers may prefer the convenience of automatic payment, while others may prefer the control and flexibility of manual payment. Let’s help you understand the two

Automatic Payments:

With Automatic Payment, marketers need to add a debit/credit card to their ad account and set a billing threshold amount. The threshold amount is a set amount that an advertiser can spend before Facebook ads bills the advertiser.

Whenever the ad costs reach the billing threshold amount, Facebook charges the marketer for that amount.

Initially, the billing amount is set to a modest amount but gets revised depending on the advertisers’ payment history. If the payment history is satisfactory, the spending limit will eventually increase.

The advertisers are charged on per month-on-month basis. Most Facebook advertisers opt for automatic payment as it allows them to easily manage their advertising costs and ensure that their ads are always running.

However, it has been observed, often time the advertisement campaigns are put on hold, especially at the end of the month, when the deducted amount reaches the threshold limit.

Marketers can prevent any possible disruption to their advertisement campaigns by recognizing problems and sticking to the provided solutions.

1. Ensure sufficient funds

Because the pricing of Facebook ads is based on an auction system, it is important for advertisers to make sure that their payment methods have sufficient funds to support their upcoming transactions and that their campaigns are not disrupted due to insufficient funds. Additionally, advertisers should regularly monitor their campaigns and adjust their bids and budgets as needed to ensure that their ads are performing well and achieving their desired objectives.

2. Check for the Credit Card Limit:

In instances when the cards or the linked account have a maximum deduction limit, the billing threshold can be adjusted to prevent payment failures.

3. Check for any Processing or Verification issues:

Marketers must frequently review the date of expiry and validate the billing details of the credit/debit cards related to their advertisement account. This will guarantee that their payment information is current and that there are no problems with processing their payments.

Manual Payment:

This is the prepaid method of Payments, where the advertiser adds funds to the account. The amount is deducted from the fund as per the campaign spending.

With manual payments, there is no payment threshold like the one in automatic payments. Once the advertiser chooses Manual Payments, they cannot switch to automatic payments and Vice-Versa.

In India, manual payments can be processed through the following methods.

- Online Transfer: Net Banking and UPI

- Wallet: Paytm

Advertisers can adopt the same by

– Opting for Monthly Invoicing:

The Monthly Invoicing method doesn’t consider the billing threshold, which prevents the ads from being paused in case of payment failure.

At the end of the month, the advertiser receives an invoice for the amount spent on the ads and will have 30 Days to pay the balance. With monthly invoicing, Facebook provides ad credits that the advertisers can redeem to clear the dues accrued by running the ads.

Monthly invoicing reduces the hassle of multiple transactions since it consolidates all the charges for a month in a single invoice, which the advertiser can clear in a single go.

– Opting for Prepaid Payment Option:

When the funds are already added to the ad account, as soon as the account reaches the billing threshold, the amount is automatically deducted from the account. This helps to prevent payment failures and ensures that the advertiser’s campaigns are not disrupted due to insufficient funds.

Facebook supports various payment methods that can be used to clear the bills as below:

- Credit Cards and Debit Cards

- PayPal

- Bank Account

- Payment Methods specific to Advertiser’s Country

Following are the details of the ones applicable in India:

- Credit Cards and Debit Cards:

- American Express

- Mastercard

- Visa

- Payment Methods specific to Advertiser’s Country:

- Net Banking

- Paytm Wallet

- UPI

- No-Cost EMI

What is the new RBI e-mandate for Facebook advertisers?

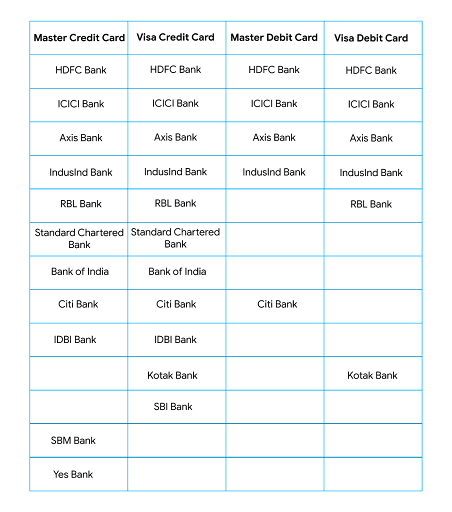

With the new e-mandate from RBI, the following are the accepted Indian Banks Cards that can be linked to the ad account:

The thing to note here is that Manual Payment can only be enabled if the advertiser selects the same while creating the Ad Account for the first time and the ad account currency is set as INR

Lastly, the advertisers wonder: “What if I fail to pay on stipulated time?”

Facebook suspends the Ad Account until the advertiser clears the payment and all the active campaigns stop running.

The biggest repercussion of this can be losing the learnings that campaigns have accumulated over the period of time and the performance being impacted since the Ads will start from square one, once the campaigns are reactivated

Hence, what we recommend is keeping a check on Ad Account Spends and Payment history details in the Billing Section of the Business Manager and ensuring timely payment of the funds to avoid this.